are funeral expenses tax deductible in ontario

Are funeral expenses tax deductible in Canada. The easy answer is no.

Are Funeral Expenses Tax Deductible Youtube

For the majority of families the costs they must lay out for a funeral are like any other major purchase along the lines of a car or new furniture.

. First month and security deposit paid upfront. However if your estate is below the. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

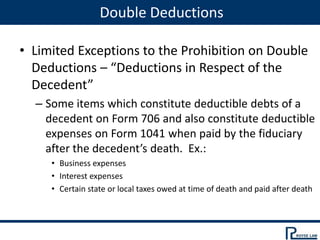

Who cannot deduct funeral expenses. If the estate in question pays federal taxes they may be able to deduct the funeral expenses on a return if the estates funds were used for the funeral costs. Unfortunately funeral expenses are not tax-deductible for.

While individuals cannot deduct funeral expenses eligible estates may be able to claim a deduction if the estate paid these costs. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns.

Monthly payments may be tax. IRS rules dictate that all estates worth. You may be able to deduct medical expenses on the deceased persons individual income tax return.

This means that you cannot deduct the cost of a funeral from your individual tax returns. As with all tax. However only estates worth over 1206 million are eligible for these tax.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. While the IRS allows deductions for medical expenses. The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases.

Can I deduct funeral expenses probate. This means that you cannot deduct the cost of a funeral from your individual tax returns. For example if you receive financial.

Up to 10000 of the total of all death benefits paid other than CPP or QPP death benefits is not taxable. Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons. The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. If the beneficiary received the death benefit see line 13000 in the Federal Income Tax. Funeral Costs Paid by the Estate Are Tax Deductible.

In short these expenses are not eligible to be claimed on a. This means that you cannot deduct the cost of a. While the IRS allows deductions for medical expenses funeral costs are not included.

Individual taxpayers cannot deduct funeral expenses on their tax return. Funeral expenses are generally not tax-deductible unless the deceaseds estate pays for the costs. In order for funeral expenses to be deductible you would need to.

Funeral and burial expenses are only tax-deductible when paid by the decedents estate and the executor of the estate must file an estate tax return and itemize the. Generally funeral expenses are tax deductible if theyre paid out of your own personal funds. Unfortunately funeral expenses are not tax-deductible for individual taxpayers.

On the federal website Canadaca it says. Individual taxpayers cannot deduct funeral expenses on their tax return. When Funeral and Cremation Expenses are NOT Tax-Deductible.

However there are a few exceptions to this rule. The Internal Revenue Service doesnt allow taxpayers to deduct expenses for funeral services or merchandise related to funeral services. Although funeral expenses are non-deductible for living individual taxpayers estates can claim these costs when the executor is preparing final tax returns.

But unfortunately this is not the case. According to the IRS website only medical expenses are tax deductible for individuals not the funeral or burial costs. What funeral expenses are deductible.

The answer to this is quite blunt.

Eirene What Government Funeral Assistance Is Available If You Can T Afford End Of Life Expenses In Canada

Common Health Medical Tax Deductions For Seniors In 2022

Can I Claim Medical Expenses On My Taxes H R Block

Are Funeral Expenses Tax Deductible Funeralocity

How To Deduct Medical Expenses On Your Taxes Smartasset

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Tax Tip When To Deduct Medical Expenses Thestreet

How To Pay For A Funeral With No Money Funeralocity

Eirene Funeral Costs In Canada Questions And Answers

New Medical Marijuana Income Tax Laws Take Effect In Louisiana As New Year Begins News Ktbs Com

Federal Fiduciary Income Tax Workshop

How To Deduct Medical Expenses On Your Taxes Smartasset

How To Pay For A Funeral With No Money Funeralocity

Federal Fiduciary Income Tax Workshop

How To Pay For A Funeral With No Money Funeralocity

Are Funeral Expenses Tax Deductible Funeralocity

:max_bytes(150000):strip_icc()/when-will-you-get-your-inheritance-3504965-FINAL-5b8813fc46e0fb0025520c3f.png)